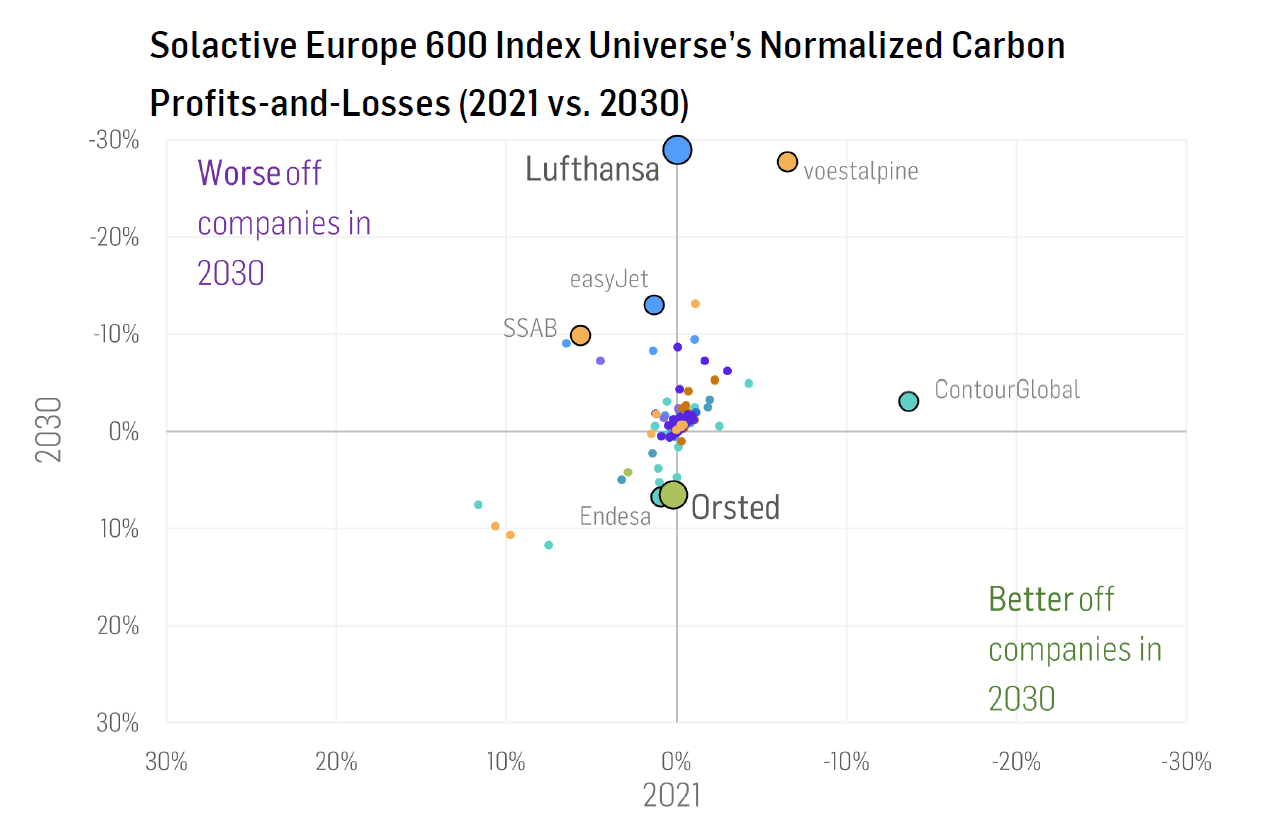

As the global economy is accelerated to net-zero carbon emissions, carbon is widely considered a problem to solve. Carbon markets are becoming ever more relevant by the day – a trend that is not expected to subside in light of global decarbonization targets. Among the most mature systems intended to incentivize decarbonization is the EU ETS. In this paper, we analyze how the EU ETS and its ripple effects could affect companies composing the Solactive Europe 600 Index by leveraging data from our strategic partner SparkChange. SparkChange provides specialist carbon data that empowers better ESG investment products and risk management, linking the financial world to carbon markets, reporting across financial institutions, and helping investors adapt to the climate crisis.