Investing & Inflation

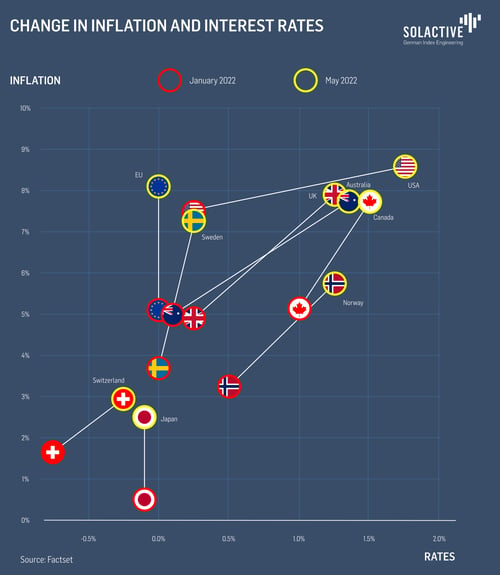

The year 2022 so far has seen major changes in the previously fairly stable (and low) environments around inflation and interest rates.

As inflation rates continue to rise we take a look at the asset classes that are commonly considered strong inflation hedges and how they really fare in high inflation regimes.

In detail we look at:

-

Precious metals / Gold / Silver

-

Oil

-

Value stocks

-

Listed real estate

Download Our Investing & Inflation report today!

Find out more about our findings on the performance of different asset classes in high inflation regimes.